Accommodation businesses across the United Kingdom are emerging from about the toughest two years they have ever endured. Many have not survived.

At the height of the pandemic in 2020, overall hospitality economic output was 42% lower than it was in 2019, and it was still 21% lower in 2021, according to a report by UK Parliament.

Now, just as this fragile sector anxiously awaits good news, B&Bs, hotels and guest houses in Scotland are bracing themselves for the introduction of a new 15% overnight stay tax. The Scottish government has passed enabling legislation introducing this discretionary new tourism tax to be imposed on anyone staying overnight in any district that chooses to implement the levy.

The tax is not expected to come into effect before 2026, but it has been universally condemned by the tourism industry and its representative bodies.

The idea of an overnight tourism levy has been floating around in Scotland for a number of years, and trade bodies such as the Bed & Breakfast Association and UKHospitality have for a long time lobbied strongly against it. In fact, had we not had COVID-19, a tourist tax would have been introduced by now, according to Leon Thompson, UKHospitality Scotland executive director. It was merely put on hold during the pandemic, he says.

He explains that the most likely place for the tax to be imposed in Scotland is the capital, Edinburgh. “This legislation will create the ability for local authorities to introduce a tourist tax if they so choose, and Edinburgh Council has been incredibly vocal in calling for a tourist tax for a number of years now, so they are most likely to pursue it,” he says.

Other local authorities will then look at it and decide whether it is something that they might like to use, he explains. However, given the timetable for introducing legislation, Thompson says the tax is unlikely to be introduced until 2026.

The chances for any further lobbying are over. “There’s no plan for any further consultation by the Scottish Government,” he says. “They are looking at the details to ensure that local authorities, when raising such a tax, invest the money generated back into the local visitor economy, making improvements for visitors and tourism generally.”

All those decisions will be made at a local level, he says. There will be an additional requirement for local authorities to consult with tourism and hospitality businesses as part of plans to activate and spend this money. One of the problems is that if it’s introduced, then that would mean Scotland would be alone in introducing such a tax, which could be off-putting particularly to visitors who may choose to stay elsewhere in the UK.

“People may feel aggrieved that we’re having to pay more to visit Edinburgh or to stay in Edinburgh, for example,” says Thompson. In addition, there is the burden that it will undoubtedly put on businesses. It is not just a simple 15% tax burden but encompasses administrative time to deal with additional costs around finance and accounting, he says. Larger businesses meanwhile may well have to upgrade their finance systems in order to manage the payments and to make sure that make sure that the levy is paid to the local authorities, he warns.

There is no guarantee that the new tax will not be extended to be imposed on day visitors, whether arriving in a city centre or disembarking from a cruise ship, he warns. “These are these are all part of the discussions and conversations that still need to be held.”

He suggests the new overnight levy, as and when it is introduced, may threaten to set taxed regions in Scotland against non-taxed regions, between competing local authorities, thus introducing regional tourism friction across Scotland.

Once the legislation has passed, then local authorities who are struggling financially may well look at how they could use such a tax to address their own revenue shortfall, even though the Scottish Government has to-date always been clear that any money raised will be invested back into the visitor economy one way or another.

Obviously, since local authorities have a choice as to whether to introduce the new tax, businesses just outside areas where the tax exists may well then benefit from more people staying with them. However, the problem with all new forms of taxation is that while they can start quite low, they do often tend to go up. For example, insurance premium tax was introduced in the UK in 2004 at 2.5%. A higher rate was then introduced, which by 2017 had risen to 20%.

The impact on hospitality business could be worsened by people simply deciding not to visit Scotland owing to the new tourism tax. A question mark is also to be raised over what the costs will be to businesses actually to administer this scheme, because it’s not cost-free nor even a cost-neutral exercise for businesses. Thompson says, “We really need to understand what the financial burdens are going to be on hospitality businesses.”

Hospitality businesses in Scotland are not altogether surprised that the tax is finally set to be introduced, he says, and he says the Scottish Government is not supporting hospitality and tourism businesses in the way that it should do by making an effort to enable it to continue as one of the world’s leading tourist destinations. “The tourist tax very much seems like the wrong tax at the wrong time,” he says. “We will also need to bear in mind that we have businesses are trying to move towards recovery, and conversely, are in the midst of a very difficult financial situation with inflation, energy costs, and consumer confidence.”

The Bed & Breakfast Association was also vocal in lobbying the Scottish government against imposing a new tax. Association chairman David Weston says, “We are opposed in principle to any new tourist taxes on top of the existing taxes on our sector such as VAT, APD, alcohol taxes, which are already amongst the highest in Europe.”

Imposing a tax in say Edinburgh that does not apply in, say, Newcastle or Manchester will distort tourism within the UK to the detriment of Scotland’s tourism sector, he warns, stressing that travel and accommodation is highly price-transparent and notoriously price-sensitive.

“Our view is that our sector already generates more in economic benefits via existing taxes and its multiplier effects than it costs,” he says. “We are also hugely disappointed that the Scottish Government chose this time to introduce this measure which will presage another burden on our hard-pressed and vulnerable sector. Only now just starting to emerge from Covid, B&Bs and guesthouses are now being made subject to 32 new licensing schemes – as “short term lets” – and of course, they are also facing ruinous energy cost hikes and double-digit inflation. On top of that we now have plans for new Tourism Taxes to hit our sector.”

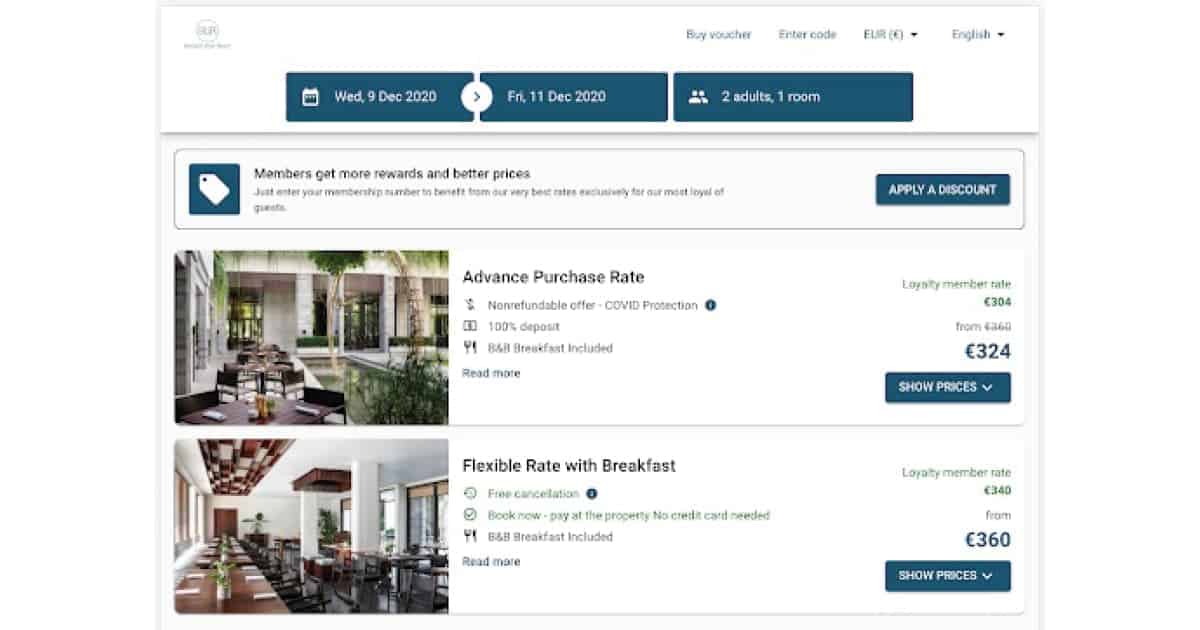

Some of the UK Government schemes to assist and support the hospitality trade during the pandemic were commendable. Hospitality businesses were eligible for business rate relief and a temporary cut to VAT, for instance. The decision by the Scottish government to press ahead with this new tax, initially charged at 15% for the cost of an overnight stay, is likely to cause untold damage to every sector of Scottish accommodation businesses and to have a knock-on effect on thousands of other businesses.

It’s a very difficult time for businesses. At 15% the tax seems to the hospitality industry in Scotland to be an act of spite, which some have unattributably likened to the burdens imposed upon their business by OTAs.

The costs of doing business in the UK are the greatest they have ever been. Hospitality is a sector which is still in a very fragile state. With the backdrop of so much economic uncertainty, the last thing that it needs are more taxes or new regulations, all of which are likely to impede their ability to resume their lockdown recovery and back towards making profit.